The problem with complexity

Businesses worldwide face the complexities of taxation for their products and customers. In the U.S., each of the 50 states has different tax rates, on top of additional tax rates at the county level. And these regulations change over time. Indeed, companies must grapple with over 12,000 taxing jurisdictions and taxes that vary depending on the product or service sold, the value of the item, and the time of year.

And sellers in the E.U. face equal complexity. In the European Union (E.U.), value-added tax (VAT) makes understanding the intricacies of cross-jurisdiction taxes a tremendous challenge. For instance, in Portugal, three different tax regions exist within the same country, with distinct taxes for the several tax categories. For intra-EU transactions, companies must grapple with things like e-services and the mini-one-stop-shop (MOSS).

Moreover, no matter where the business is located, sometimes companies don’t have a simple relationship between the buyer and the seller; they have a triangular relationship between seller, buyer, and shipper. And if you have a tax audit, you need to make sure your financials, including your taxes, are accurate.

Because of these many variables and the tremendous burden on businesses to ensure accurate taxation, Avalara developed a paid cloud service solution called AvaTax. And a new integration between Odoo and Avalara AvaTax helps companies gain an accurate understanding of today’s complex sales and use tax compliance. Your Odoo software sends a request to this service, including all the relevant information, so that the proper taxes will be computed. Companies can also use the solution to file tax returns—even if it’s multiple states where you carry commercial transactions. OSI recognized the value of integrating these two solutions, which led to developing a connector available to Odoo’s community.

Avatax Connector to Odoo

The OCA connector allows businesses to integrate their open source Odoo ERP solution with AvaTax service which supplies sales tax calculation for all U.S. states and territories and all Canadian provinces and territories.

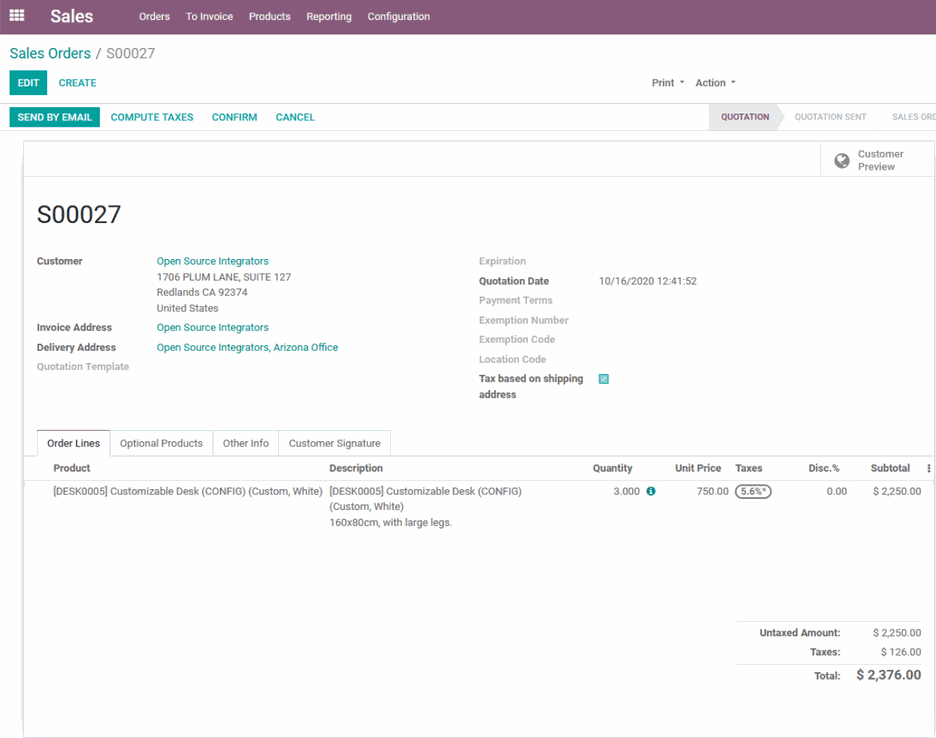

The AvaTax solution works simply yet powerfully. Your software sends a request to this service with all the relevant information. This includes seller address, buyer address, the shipping warehouse address, product details, and more. The solution then assesses tax rates based on geolocation to ensure customers are charged the right rates for their purchases. They also supply address validation for improved invoice accuracy. Because some jurisdictions have different rates for items based on price, materials, and other variables, AvaTax calculates rates for product-specific tax rates, sales tax holidays, shipping and handling rules, and more. It also makes it easy to export data from different business systems to create reports for transactions, liabilities, and tax exemptions.

For this and other reasons, AvaTax combined with Odoo ERP provides powerful capabilities. ERP data is integrated from manufacturing, accounting, CRM, products, warehousing, and more. It is then connected to the AvaTax solution, with businesses benefiting from seamless data exchange to perform functions faster and with greater accuracy and reliability and, in this case, specifically related to taxes.

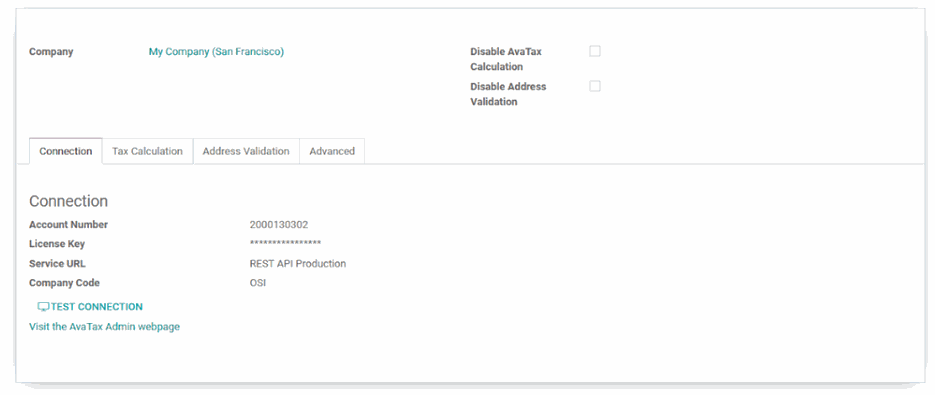

Available in Odoo Enterprise and Community, the AvaTax connector, once configured, operates in the background and performs calculations while reporting seamlessly to the AvaTax server. Account information that accesses the AvaTax dashboard can be obtained through the Avalara website. In addition, the Odoo 14 version is in beta and is expected to be released soon. The module is free of charge and has been awarded official certification from Avalara engineers, but the AvaTax service includes a fee.

At Version 12, OSI refactored the SOAP API to the REST API, a significant effort meant to benefit the community. For Version 13, Odoo invoices were refactored as account moves.

You can access the connector at the Github Repository: https://github.com/OCA/account-fiscal-rule. Future work will include adding VAT support and certification, adding ecommerce and point-of-sale integration, improving documentation, and more.

All of this means one simple thing for OCA members: the Avatax Connector to Odoo lets them gain clarity into a complex tax system. They can seamlessly use data across their open source ERP and leverage AvaTax to effectively manage today’s sale and use tax compliance. And because it’s part of the OCA community, its development will continue with members benefiting for years to come.

Want to learn more about the Avatax Connector to Odoo available in the OCA? Check out the OCA Days 2020 presentation from OCA board member Daniel Reis, Managing Director at Open Source Integrators.

The views and opinions expressed are those of the author and do not necessarily reflect the official policy or position of the Odoo Community Association. Any content provided by our sponsors or authors are of their opinion and are not intended to malign any religion, ethnic group, club, organization, company, individual or anyone or anything